What if the house around the corner sells higher than yours even though both have the same square footage and a similar floor plan? In Frisco, Plano, and McKinney, that happens often because small, block‑level details change value more than most city or zip code averages suggest. If you are planning to sell or move up, you want to price and position your home based on what buyers actually pay for on your street, not across town. In this guide, you will learn the micro‑market factors that move prices block by block and the steps to comp and price with confidence. Let’s dive in.

Micro‑market pricing, explained

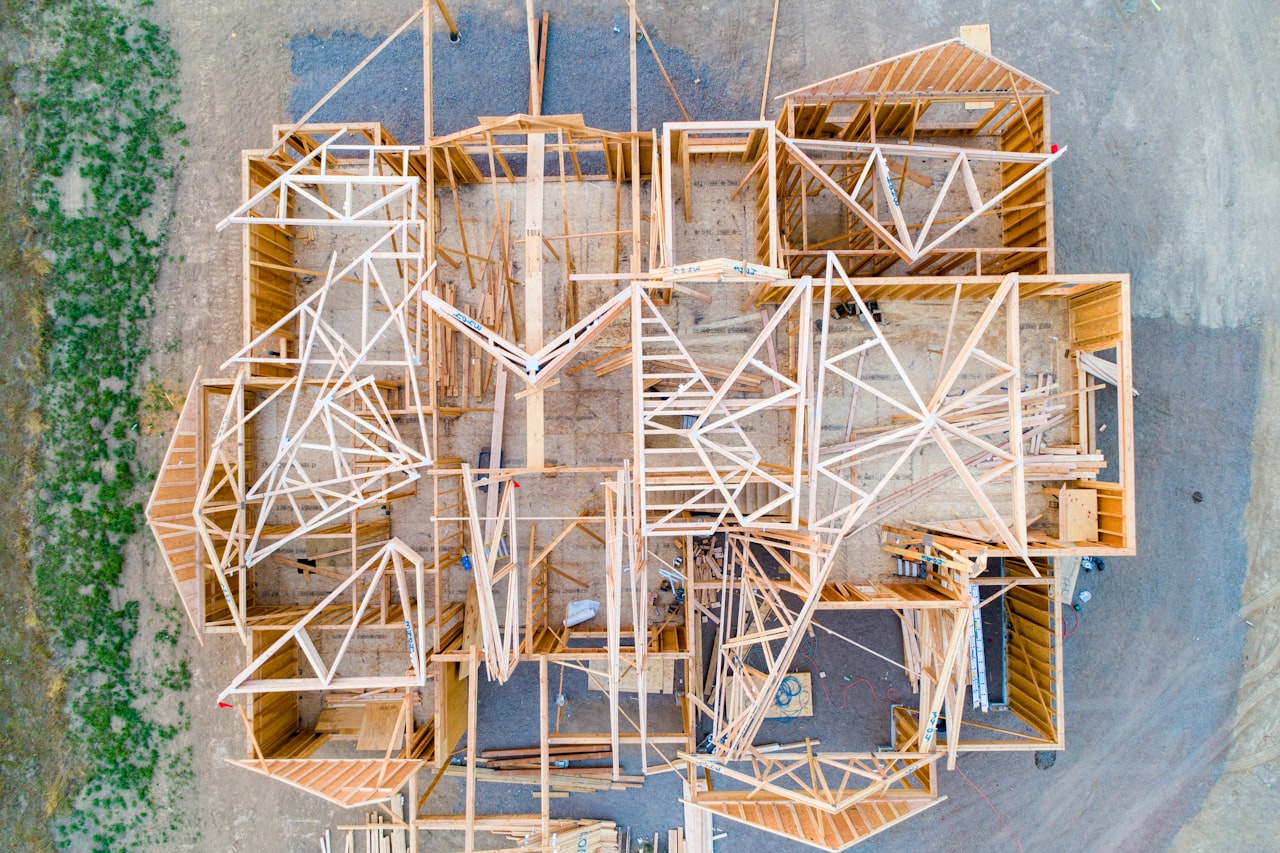

City or zip‑level trends help with big‑picture context. But in Collin County suburbs with both established neighborhoods and new construction, averages hide meaningful differences. Newer product can sit a few blocks from 1990s homes. Builders may release a cluster of spec houses at once while a nearby resale pocket has limited turnover. The result is wide price dispersion that you only see by zooming in.

Micro‑market pricing means you define a home’s competitive set by builder, era, lot, amenities, and immediate inventory, then adjust with recent local sales. It is a street‑by‑street approach that aligns with how buyers actually shop and decide.

Key drivers that shift value

Builder and product line

Who built the home and which product tier matters. Semi‑custom or higher‑end production lines often carry premiums over entry‑level lines, even inside the same subdivision. Features like ceiling height, masonry versus siding, and structural options influence buyer perception and price. A common mistake is treating all homes in one community as equal when builder and product vary.

Age and era of construction

Era shapes layout and systems. Newer builds and recently remodeled homes tend to attract more buyers in fast‑growing suburbs. Older homes with modernized kitchens and baths can compete, but timing for big replacements like roof or HVAC affects value. Do not confuse cosmetic refreshes with structural improvements that buyers weigh heavily.

Lot characteristics and position

Lot advantages often drive the largest block‑to‑block price differences. Usable backyard space, privacy, cul‑de‑sac position, and views of greenbelt or water can create meaningful premiums. Corner lots might add exposure or parking flexibility but can also raise privacy concerns, so impact varies. Look beyond acreage to usability, topography, drainage, and orientation, especially for sun exposure in warmer months.

Amenities and micro‑location

Assigned school campuses, park and trail access, and proximity to shopping and key corridors all shape buyer demand. Being on the side of a street that places you closer to a school or a park can change the buyer pool and price outcomes. Private HOA amenities, such as pools and trails, also influence demand. Do not assume every campus in a district carries the same effect. Verify school assignments and use neutral, factual sources.

Inventory pockets and timing

New construction often releases in waves. A cluster of spec homes can set temporary benchmarks that do not reflect long‑term resale value. At the same time, a nearby pocket with low turnover may sustain premiums due to limited supply. Avoid pulling list prices from builder pockets without adjusting for incentives and closing credits.

Upgrades, condition, and layout

Functional layouts, such as open kitchens and a main‑level bedroom suite, are powerful. So are durable flooring, updated baths, and well‑executed finishes. Deferred maintenance suppresses value and shrinks the buyer pool. Staging can help presentation, but it does not replace structural and functional improvements buyers prioritize.

How to comp and price in Frisco, Plano, and McKinney

Map your micro‑market

Define boundaries street by street, not by zip code. Respect master plan edges, creeks, major roads, and neighborhood fencing. When possible, compare homes built by the same builder and product line, within the same era, and on the same block face.

Use recent solds, then layer recency

Start with sold comps from the last 6 to 12 months that match size, builder or era, and lot position. In fast‑moving pockets, also review pending sales and current days on market to understand momentum. Separate builder sales from nearby resales and adjust for included features and incentives.

Make systematic adjustments

Adjust for lot position and size, age and condition, interior square footage, bed and bath count, garage configuration, and view. Use paired sales or grouped comparisons to derive local adjustments. Then validate with live market feedback, such as showings, offers, and buyer comments during your listing period.

Pair data with street checks

Data and models help, but they miss small details like short stretches of commercial noise, weekend street parking, or a unique HOA rule. Walk and drive the block at different times of day. Look for drainage, boundary fences, driveway approach, and road conditions. These on‑the‑ground checks protect your pricing from surprises later.

Compare new build and resale separately

New construction typically includes warranties, newer standards, and pricing structures that reflect newness. When you compare a resale to a new build, isolate the lot premium, included upgrades, appliance packages, and incentives such as closing credits. For older resales, disclose replacement timing for major systems to help bridge perceived gaps.

Positioning strategies for sellers

- Price with precision. In tight, well‑defined pockets, a slightly assertive list price can spark multiple offers. In mixed pockets, a too‑high ask can stall momentum and lead to re‑pricing.

- Market what matters. Highlight lot strengths, builder pedigree, functional layout, and verified school assignments instead of broad city‑level talking points.

- Use professional presentation. Clean condition, repair documentation, and strategic staging can improve both perceived and appraised value.

Data sources to verify before you price

- Local MLS and market activity. Use subdivision‑level solds, pending activity, days on market, and list‑to‑sold ratios. Regional MLS access is managed through organizations such as the NTREIS system and the MetroTex Association of Realtors.

- Parcel and lot details. Confirm lot size, year built, and improvements using the Collin County Appraisal District parcel data.

- School assignment and performance. Verify campus assignments and review neutral accountability data from the Texas Education Agency performance reporting.

- Upcoming development. Check city planning and permits for new subdivisions, road work, or nearby infrastructure that could affect value or short‑term livability. City planning departments publish updates and maps on their official websites.

- HOA or master plan details. Confirm amenity access, fees, and any special assessments or restrictions that might influence buyer decisions.

Move‑up buyer playbook

Move‑up buyers often weigh newer finishes, bigger lots, and specific school assignments. That means you may sell in one micro‑market and buy in another with different inventory and timing dynamics. Map both micro‑markets early so you can time offers and contingencies with less stress. If you need flexibility between selling and buying, ask about options that can support sequencing and presentation.

For many sellers, small improvements, repairs, and staging help your home compete with nearby new builds. A coordinated plan also lets you keep speed and control during the listing period.

How our team makes it simpler

You deserve pricing that reflects your block, not a broad average. Our team builds a street‑level comp map, verifies parcel and lot data, and checks builder product lines so you list with confidence. We coordinate repairs and staging to spotlight the features buyers pay for in your pocket, and we keep a close eye on new‑construction releases that could shift demand.

If you are making a timing‑sensitive move, we can walk you through program options available through Compass that may help with presentation and sequencing. Our goal is a smooth, well‑priced sale and a smart purchase that fits your family and budget.

Ready to see what your home could sell for in your exact pocket? Reach out to the Pickard Real Estate Group for a street‑level pricing consult.

FAQs

Why do similar homes sell differently in the same neighborhood?

- Lot position, builder and product line, upgrades, layout, and verified school assignments can shift demand and pricing. Micro‑market comping isolates these differences so you price accurately.

Should I price to match the city or zip code median?

- No. City or zip medians are too broad and can cause overpricing or underpricing. Use recent solds from your immediate pocket, then adjust for lot, builder, and condition.

How do builder incentives affect nearby resale values?

- Incentives such as credits or rate buydowns can set short‑term expectations in a new‑build pocket. Adjust comps to account for incentives and highlight resale advantages like lot quality or upgrades.

What data should I review before listing in Frisco, Plano, or McKinney?

- Pull subdivision‑level solds and pendings, confirm parcel details with the appraisal district, verify school assignments with TEA resources, and check city planning for upcoming projects.

How often do micro‑market premiums change in Collin County?

- Premiums can shift quickly with new infrastructure, school rezoning, or builder release cycles. Review activity weekly once you approach listing and stay flexible on positioning.