Buying a home in Frisco or Plano moves fast. When your offer is accepted, you want time to inspect and make sure the house is right without losing your place in line. That is exactly what the Texas option period gives you.

In this guide, you will learn how the option period works in Texas, the difference between the option fee and earnest money, and how to use this time to complete smart inspections in Collin County. You will also see tactics that help you stay competitive while still protecting yourself. Let’s dive in.

What the option period is

The option period is a negotiated window that gives you an unrestricted right to terminate the contract for any reason. If you end the contract correctly within this window, your earnest money is typically refunded according to the contract.

You buy this right by paying a small, non-refundable option fee to the seller. The length of the option period and the fee amount are both written into your Texas resale contract.

During this time, your focus is inspections, due diligence, and any repair or credit negotiations. If you decide the home is not a fit, you must give written notice before the option period expires.

Option fee vs. earnest money

These two payments serve different purposes.

- Option fee: A small, non-refundable payment to the seller that buys your right to terminate during the option period. It may be credited at closing only if the contract says so.

- Earnest money: A larger deposit held by the title or escrow company to show good faith. If you terminate properly during the option period, it is usually refunded per the contract.

Most buyers in Collin County see option fees in the 100 to 500 dollar range, though in hot situations buyers sometimes offer more. Earnest money is larger and goes to the title company.

How timing and deadlines work

A few key timing terms guide everything.

- Effective date: The date the contract becomes binding. This starts the clock for many deadlines, including the option period.

- Option period length: Negotiated and written in the contract. In Collin County, common ranges are 3 to 10 days. In competitive moments, some offers use 0 to 3 days.

- Counting days: The contract counts calendar days unless the form states otherwise. Your written termination must reach the seller or the seller’s agent before the option period expires.

- Extensions: The option period can be extended only if both parties agree in writing. An additional option fee is commonly negotiated for more time.

Tip: Keep clear proof of any termination delivery, such as a timestamped email or signed receipt. When time is tight, use more than one delivery method and confirm receipt.

What to inspect in Collin County

Your option period is the time to investigate the property. Schedule these items right away so you have results before the deadline.

- General home inspection: The baseline check of structure, electrical, plumbing, HVAC, roof, and more.

- Foundation or structural evaluation: North Texas has expansive clay soils that can cause slab movement. If you see cracks, doors sticking, or prior repair notes, consider a licensed engineer or foundation specialist.

- Pest and wood-destroying insect inspection: Standard in Texas.

- Roof review: Especially important given North Texas hail exposure.

- HVAC specialist: Helpful for older systems or unusual performance.

- Pool and spa inspection: If applicable, to check leaks and equipment.

- Septic and well: If the property uses these systems.

- Survey and easements: Review fence lines, encroachments, and access.

- Floodplain check: Confirm flood zone status and whether flood insurance is required or advisable.

Local priorities in Frisco, Plano, and McKinney include foundation health, drainage and irrigation impacts on the slab, and roof condition. If the home is newer, also ask about any builder warranty coverage and prior repair records.

Typical inspection costs

- General home inspection: About 300 to 600 dollars, depending on size.

- WDI or termite inspection: Roughly 50 to 150 dollars.

- Structural engineer or foundation evaluation: Often 400 to 1,500 dollars or more based on scope.

- Roof, HVAC, and pool specialists: Additional and vary by provider.

Book early. Inspectors here often schedule within 24 to 72 hours, but busy seasons can push lead times.

Smart negotiation during the option period

Once you have the reports, you will decide how to move forward. Common outcomes include:

- Seller completes certain repairs before closing.

- Seller offers a closing credit in place of repairs.

- Both sides agree to a limited repair list.

- Seller declines requests, and you either proceed as-is or terminate within the option period.

- Price adjustment or other term changes instead of repairs.

Sellers are not required to make repairs unless the contract says so. Most outcomes come from negotiation and current market leverage. In hot conditions, some sellers limit repairs to safety or major systems, or they prefer a credit rather than coordinating work.

Competitive strategies for Frisco–Plano buyers

You can stay competitive and still protect your interests. Consider these approaches.

- Shorten, do not waive: Offer a 2 to 3 day option period rather than a long one. This keeps your right to terminate but signals confidence to the seller.

- Increase the option fee: A higher fee can strengthen your offer because it compensates the seller for time off the market. Remember, it is non-refundable.

- Pre-book inspections: Line up your inspector for the same day the contract goes effective, especially if you are using a short option period.

- Ask for credits: If you want control and speed, request a closing credit instead of seller repairs.

- Strong earnest money: Shows commitment while you still keep option protections.

- If waiving the option: Budget for repairs and, where possible, pull quick quotes in advance so you understand the risk.

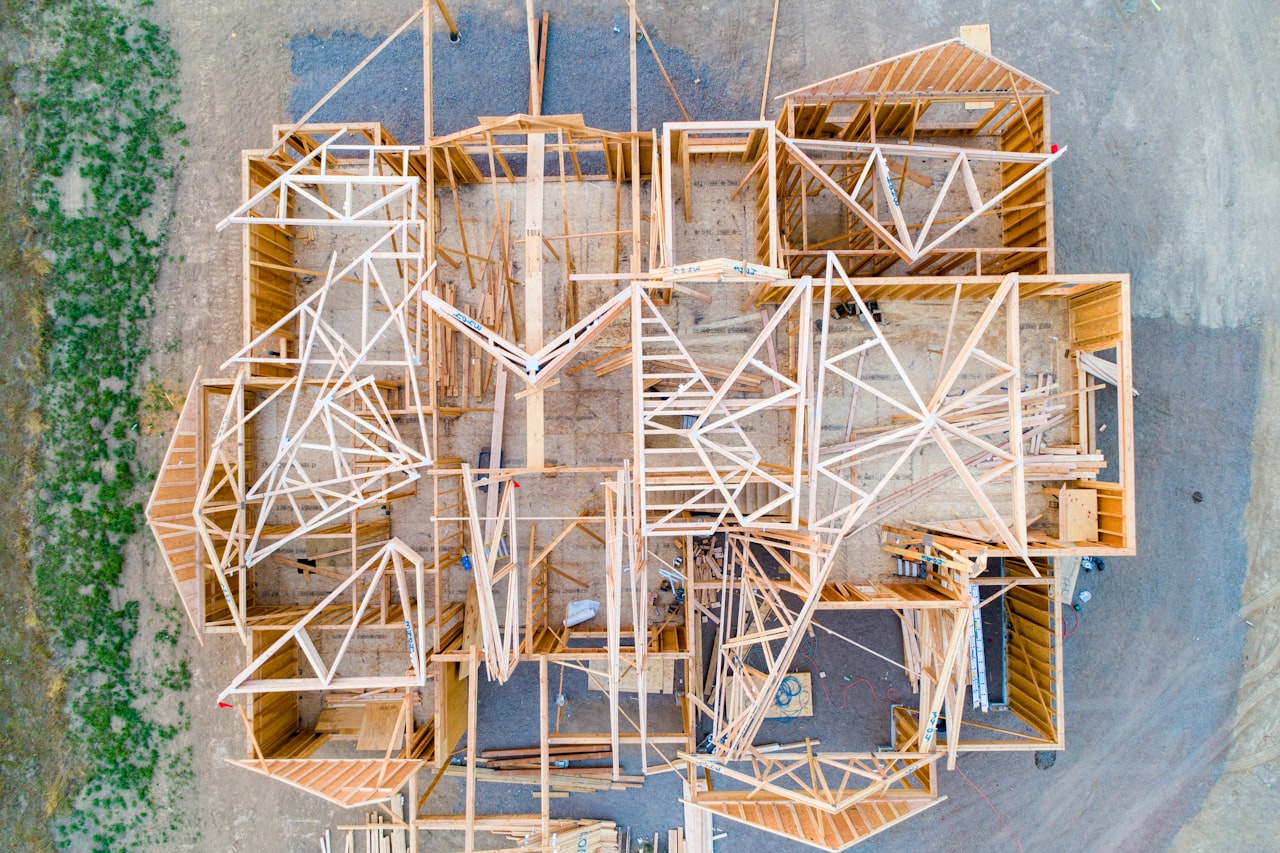

New construction vs. resale

New construction in Frisco and McKinney often uses builder contracts that work differently than the standard resale contract. Builder agreements may limit your unconditional right to terminate and follow a separate inspection and punch-list process.

Review the builder’s warranty coverage, inspection windows, and repair procedures in writing. Plan your punch-list walkthroughs carefully, and get warranty details for structure, systems, and workmanship.

Sample timelines you can use

Scenario A: Typical buyer with a 7-day option

- Day 0: Contract effective. Pay the option fee and deliver earnest money to the title company.

- Day 0 to 1: Schedule the general inspection and any needed specialists.

- Day 2 to 5: Review reports and get estimates for major items, such as foundation or roof.

- Day 6: Submit repair requests or deliver written termination if needed.

- Day 7: Option period expires at the end of the day. Any termination must be delivered before the deadline.

Scenario B: Competitive offer with a 2-day option and higher option fee

- Day 0: Contract effective. Pay the higher option fee and deposit earnest money.

- Day 0: Inspector visits the property that same day, if pre-booked.

- Day 1: Reports arrive. Decide whether to proceed, request targeted concessions, or terminate.

- Day 2: Option period expires.

Your option period checklist

Use this quick list to stay on track.

- Confirm option fee amount and payee. Deliver it immediately as your contract requires.

- Deposit earnest money with the title company on time.

- Pre-book a general inspector and any specialists with availability inside your option days.

- Review the seller’s disclosure, HOA documents, and any prior reports.

- Review the survey and flood maps. Request records for any past foundation repairs or engineering evaluations.

- Obtain estimates from licensed contractors for any major issues found.

- If needed, deliver written termination to the seller or the seller’s agent before the option period ends. Keep proof of delivery.

Work with a local guide

Your option period is short, and choices come fast. A trusted local team helps you set the right option length and fee, book the right inspectors, and negotiate repairs or credits that match the market in Frisco and Plano.

If you are ready to buy in Collin County and want a steady hand, reach out to the Pickard Real Estate Group. We will help you plan a smart offer, move quickly on inspections, and protect your interests from day one.

FAQs

What is the Texas option period in a home purchase?

- It is a negotiated window that gives you an unrestricted right to terminate the contract for any reason, in exchange for a non-refundable option fee paid to the seller.

How do option fee and earnest money differ in Texas?

- The option fee buys your termination right and is non-refundable, while earnest money is a larger good-faith deposit held in escrow that is typically refunded if you terminate properly within the option period.

How are Texas option period days counted?

- They are counted in calendar days from the effective date. Written termination must be delivered to the seller or the seller’s agent before the option period expires.

Can I extend my Texas option period after inspections start?

- Only if the seller agrees in writing. Extensions are negotiated and may require an additional option fee.

What inspections matter most in Collin County?

- General home inspection, foundation or structural evaluation due to expansive clay soils, roof review for hail damage, HVAC check, and pool or pest inspections where applicable.

What if I miss the Texas option period deadline?

- You lose the unrestricted right to terminate under the option clause. Other contract clauses may still apply, but your earnest money could be at risk if you later default without a contractual basis.

Should I waive the option period to win in Frisco or Plano?

- Waiving increases risk. Safer options include shortening the option period, raising the option fee, pre-booking inspections, or seeking repair credits instead of seller repairs.

How does new construction in Frisco or McKinney change the process?

- Builder contracts often use different forms, limit unconditional termination rights, and rely on warranty and punch-list procedures, so review timelines and coverage in writing before you rely on resale contract assumptions.